Expectancy Value (EV)

Introduction

My first real introduction to the principle of Expected Value came while working at FTX. At FTX, decisions – both major and minor – were routinely evaluated through the lens of EV. This rigorous approach to decision-making deeply influenced my personal philosophy. Upon my return from the Bahamas, I found myself evaluating almost every aspect of my life with EV. It became more than just a decision-making tool—it was a mindset.

1. Understanding Expected Value (EV):

At its core, EV provides a means to quantify the potential value of a decision, considering all possible outcomes. The formula is:

EV = (probability of outcome × value of outcome)

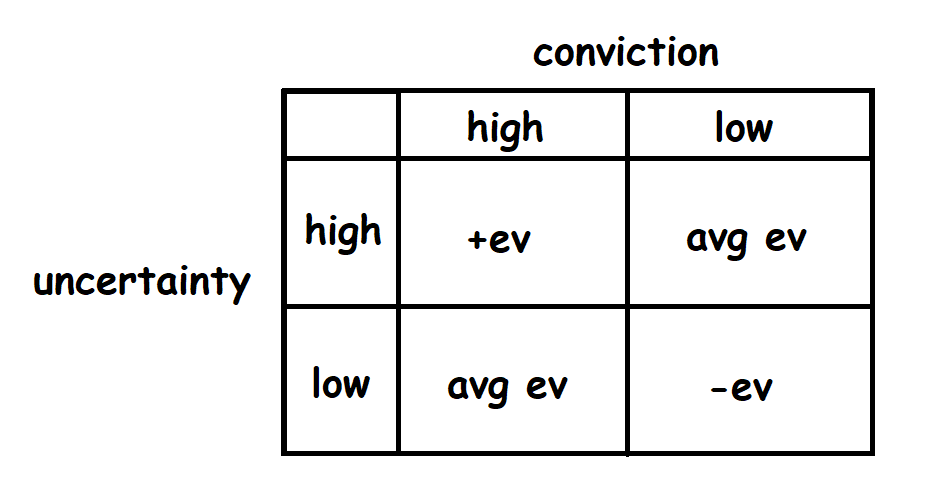

2. EV in Trading:

Though not a full-time trader, I occasionally venture into the trading world, and here's where EV comes into play:

- Risk Evaluation: Understanding the EV of a trade lets me determine its potential profitability, helping me decide if it's worth the risk.

- Investment Choices: Calculating the EV offers insight into the potential return and inherent risks before investing in crypto or other assets.

gmeow and welcome to another boring thread (hopefully not) so dog doesnt get fired by the hedgy hog

— kinnif 🟪 (@0xkinnif) October 5, 2023

unlike the typical 'Navigating the Dark Forest with dog' threads, today dog will be discussing more about something more trading related - expected value pic.twitter.com/uBagoPqVie

3. EV in Software Engineering and Project Management:

Beyond trading, my primary role as a software engineer has numerous opportunities to apply EV:

- Bug Prioritization: When multiple issues arise, calculating the EV of fixing each bug—considering factors like user impact and fix effort—helps in prioritizing them.

- Feature Development: Deciding which feature to develop next can be informed by the EV, weighing the potential user benefits against development time.

4. EV in Day-to-Day Decisions:

Everyday life brims with choices. In seeking wisdom to navigate these choices, ancient scriptures like the Bhagavad Gita offer profound insights. A relevant verse from Chapter 2, Verse 40 goes:

"नेहाभिक्रमनाशोऽस्ति प्रत्यवायो न विद्यते |स्वल्पमप्यस्य धर्मस्य त्रायते महतो भयात् ||"

Translating to:

"In this endeavor there is no loss or diminution, and a little advancement on this path can protect one from the most dangerous type of fear."

This philosophy aligns with the application of Expected Value. By understanding and applying the principles of EV, even in modest ways, we can move forward in life with a protective armor against the fears of poor decision-making.

- Financial Decisions: When faced with significant financial choices or potential investments, the tool of Expected Value can guide us in evaluating outcomes and risks.

- Career Moves: Whether it's considering a new job offer or undertaking a fresh project, assessing the EV can give clarity, weighing potential rewards against possible pitfalls.

5. Challenges and Limitations of EV:

Despite its advantages, one should be wary of relying solely on EV:

- Data Accuracy: The value derived from EV is contingent on the accuracy of the probabilities and outcomes inputted.

- Emotional Aspects: Life decisions aren't always made on logic alone. Personal and emotional factors can, and often do, play significant roles.

Conclusion:

The beauty of Expected Value lies in its versatility. Whether you're diving into the world of trading, navigating the intricacies of software engineering, or making life's myriad decisions, EV offers a structured way to evaluate options. As with any tool, its power is realized best when used judiciously and in conjunction with other decision-making aids.